Ultimate Guide To Staking Cryptocurrency

Chances are if you hold a cryptocurrency, you could earn staking rewards by putting your cryptocurrency to work. One way is by lending your cryptocurrency, and the other is by staking.

This resource compares the different ways you can earn yield from staking your cryptocurrency, where to go, risks to think about and whether to use a centralised platform or DeFi.

What is Staking?

Staking is when you commit or delegate your cryptocurrency to help confirm transactions on a blockchain. Not all cryptocurrencies can be staked, only one’s which support Proof of Stake (PoS). Staking your cryptocurrency helps the network run—and users earn a yield or reward for doing so.

Staking is quite a broad term, with many deviations or specific implementation depending on the particular cryptocurrency and how it operates—for this resource, we won’t go into the specifics.

This means your PoS cryptocurrencies can be put to work to earn extra income, and many users choose to put their idle crypto to work to earn a yield.

Further reading: All About Staking

How to Stake Cryptocurrency

How to stake your cryptocurrency depends on 2 things:

- Your cryptocurrency.

- Whether you want to stick to a centralised platform or use DeFi.

Both have many benefits and cons, depending on your personal preference.

Which Platform Supports Your Cryptocurrency?

Not all cryptocurrencies can be staked, only those whose blockchains use PoS. Not all exchanges or platforms will support all PoS cryptocurrencies or staking.

Your choice of exchange or platform will also depend on how much cryptocurrency you have—there will be minimum amounts depending on the specific cryptocurrency, wallet or exchange.

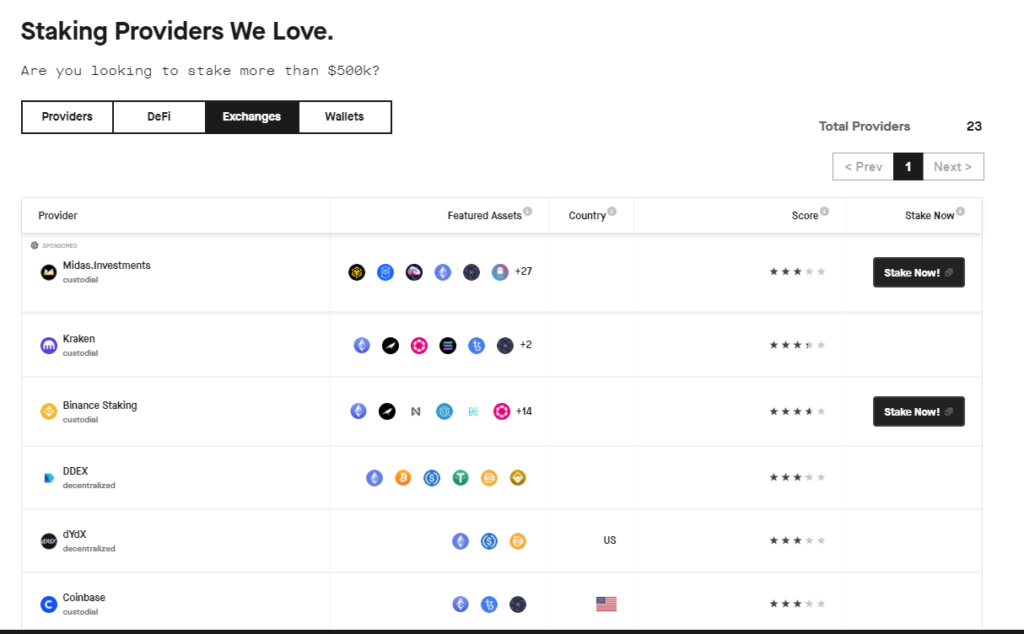

Luckily there are tools like stakingrewards.com to compare staking providers, DeFi, exchanges and wallets with supported assets.

Staking via a Centralised Platform

Centralised platforms such as Binance, Kraken, or Coinbase are centrally controlled and in charge of a user’s cryptocurrency. These platforms can be used to buy and sell and have staking services available.

Who might use a CEX instead of DeFi? If you want minimal fuss, fewer clicks, less interaction with web wallets and smart contracts, you might prefer the simplicity of centralised platforms.

Each platform will support different cryptocurrencies, and rates vary—there are pros and cons of using a centralised platform.

| Pro | Con |

| Ease of use, fewer clicks, all-in-one. | Reliqnish your cryptocurrency. Not your keys. |

| Avoids using a web wallet. No need to interact with smart contracts. | Less competitive rates. Can increase centralisation. |

| Cost-efficient if staking smaller amounts. Can access staked ETH right away | Trust, platform risk. |

Centralised platforms for staking your cryptocurrency

- Binance: Supports 100+ assets via locked staking. All in the one place.

- Coinbase: Supports ETH, ALGO, ATOM and TEZ. Limited selection.

- Kraken: 13+ assets featuring ADA, ATOM, ETH, FLOW, KSM, DOT, and SOL, amongst others.

- FTX: Offers a small selection of coins, such as FTT, SRM, SOL and RAY.

- Bitfinex: Supports 10+ cryptocurrencies with those cryptocurrencies not locked.

- Others include Crypto.com, Huobi Global or eToro.

- Swyftx: Australia users can stake 16+ cryptocurrencies with no lock-up.

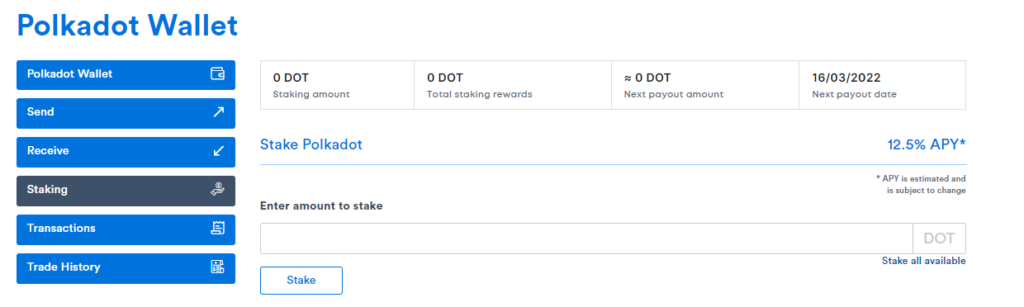

- CoinSpot: A great simple option for Australian users. A wide range of cryptocurrencies, such as 12.5% APY on DOT, with no lock ups. Stake via your wallet.

Analyst take (Nick): I think Binance is the most convenient, all-in-one option, followed by Kraken and Coinbase for beginner-friendly options and those who want minimal fuss when staking. For Australians, CoinSpot and Swyftx offer competitive rates with no lock-up.

Stake via DeFi

If the above doesn’t sound like you, there’s the option to stake via DeFi.

DeFi is when you use a web wallet (MetaMask) or desktop wallets (Exodus) to connect directly to Dapps or networks to stake your cryptocurrency.

Just as not all cryptocurrencies can be staked, there are also limits and often barriers to how much cryptocurrency you need to stake or knowledge/equipment.

For example, to stake with Ethereum, you need technical knowledge to run a node to stake and 32 ETH.

Most people don’t want to run their own equipment—this resource will be looking at ways for users to stake cryptocurrency without the need to run their own node.

Who might use DeFi instead of a CEX? Users who want to retain their private keys and keep the autonomy of their cryptocurrency. They might be more comfortable with web wallets and signing transactions.

Like centralised platforms, there are pros and cons of both.

| Pro | Con |

| Higher rates, CEX can take a higher cut. | Gas can be high, especially on Ethereum. |

| More control, retain your crypto. | Trust in a pegged synthetic token. Limited early withdrawals. |

| Utility, more options and often more decentralised. | Smart contract risk, many different platforms. |

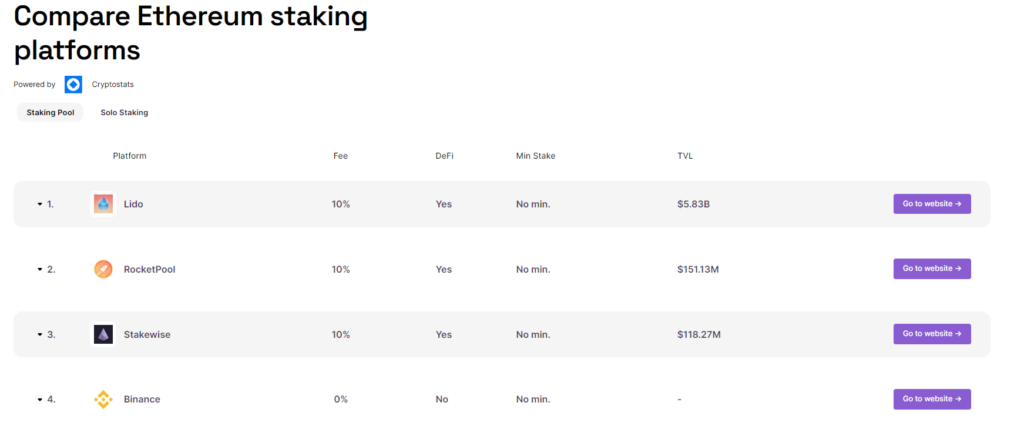

Compare the best ETH staking rates with cryptotesters!

Ways to stake via DeFi

There are 3 main ways to stake in DeFi:

- Directly with that platforms native platform or wallet.

- Staking service providers.

- Third party wallets such as Ledger or Exodus.

Staking direct

Depending on the cryptocurrency, you can stake directly with that cryptocurrencies official wallet and platform, for example, with Avalanche (AVAX).

AVAX: By going to wallet.avax.network users can directly stake their AVAX through the ‘earn’ tab: by becoming a validator or delegator.

Staking service providers

Most PoS cryptocurrencies have staking service providers. They operate ‘staking pools’ and provide ‘staking-as-a-service’ by running nodes for decentralised PoS protocols on behalf of investors. This ensures smaller users can participate in the network’s security (and yield) without the time and technical demands of running a node.

Some popular staking service providers include:

Lido: Supports Ethereum, Solana and Kusama networks. Users receive ‘st’ assets in return—with users able to earn extra yield wherever these assets are supported—for example, stETH.

RocketPool: Only supports ETH. Staked ETH is represented by rETH.

Stake.fish: Supports a wide range of PoS cryptocurrency networks such as Ethereum, Polkadot, Cosmos, Tezos, Cardano, Solana, Polygon and Kusama, among others.

Stakewise: Only supports ETH; sETH2 and rETH2 represent staked ETH.

Others: Less established options also include Figment, Staked or MyCOINTAINER.

Staking via wallets

If you don’t want to use DeFi or these staking services directly, you can stake via third-party wallets: whether you’re using a desktop wallet like Exodus or your hardware Ledger wallet.

Other wallets which support staking include Phantom, Atomic wallet, Guarda wallet, Argent or Trezor.

Exodus

You can stake via desktop wallets such as Exodus. This way, you retain your cryptocurrency and don’t need to go directly to platforms or even use a centralised exchange. Exodus offers an extensive amount of supported cryptocurrencies.

Ledger

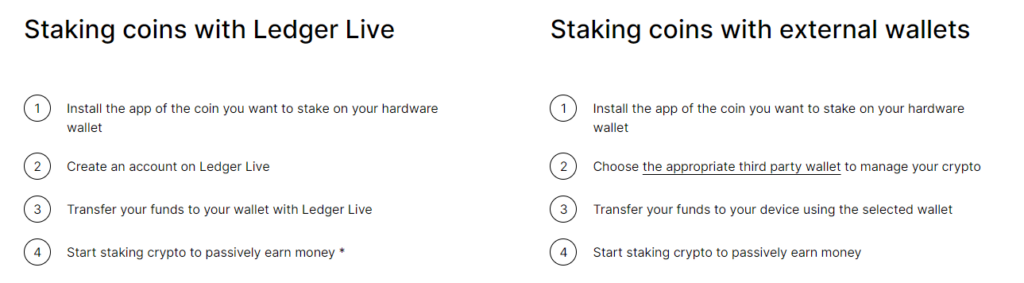

Users can also stake via Ledger hardware wallets: staking directly with Ledger Live or staking via an external wallet (connecting your Ledger). Ledger is compatible with Ethereum, Polkadot, Tezos, Cosmos, Algorand and Tron networks for staking.

Risks of Staking

Staking cryptocurrency is not without its risks, be careful to consider:

- You may have to lock your cryptocurrency up for a fixed amount of time. For example, ETH withdrawls are not yet live.

- If you are buying just to stake consider price volatility may outweigh APY.

- There’s a risk of losing some cryptocurrency if the validator you’re staking with misbehaves (known as “slashing”).

- Platform risk of using a centralised exchange that shuts down.

Round Up

Analyst’s take (Nick): If you can stake your cryptocurrency, it makes sense to put it to work and earn a yield. Consider which option is best for you—whether you prefer to forego slightly higher rates and anatomy for the all-in-one convenience of a centralised platform or prefer staking directly from your Ledger.

It’s essential to be wary of ‘high’ staking APYs. If a cryptocurrency has a staking APY of >20%, this could be a red flag as most legitimate cryptocurrencies often don’t have an APY that high. And if you want to sell your cryptocurrency in the short term, ensure your cryptocurrency can be instantly withdrawn (ETH at this stage cannot be withdrawn when using a staking service provider).

———

All information contained in this resource is not to be considered financial advice of any kind, and you should obtain independent legal, financial, taxation and/or other professional advice in respect of any decision. You acknowledge that any information provided is generic in nature and does not take into account your specific circumstances.